IRS 12180 1999-2025 free printable template

Show details

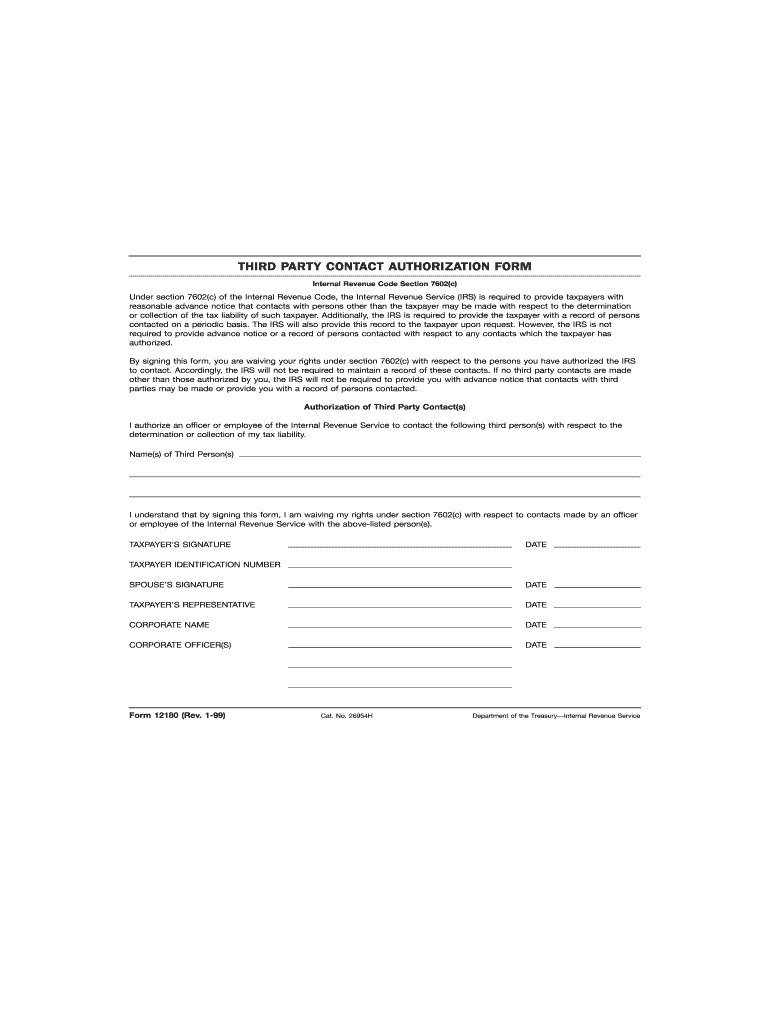

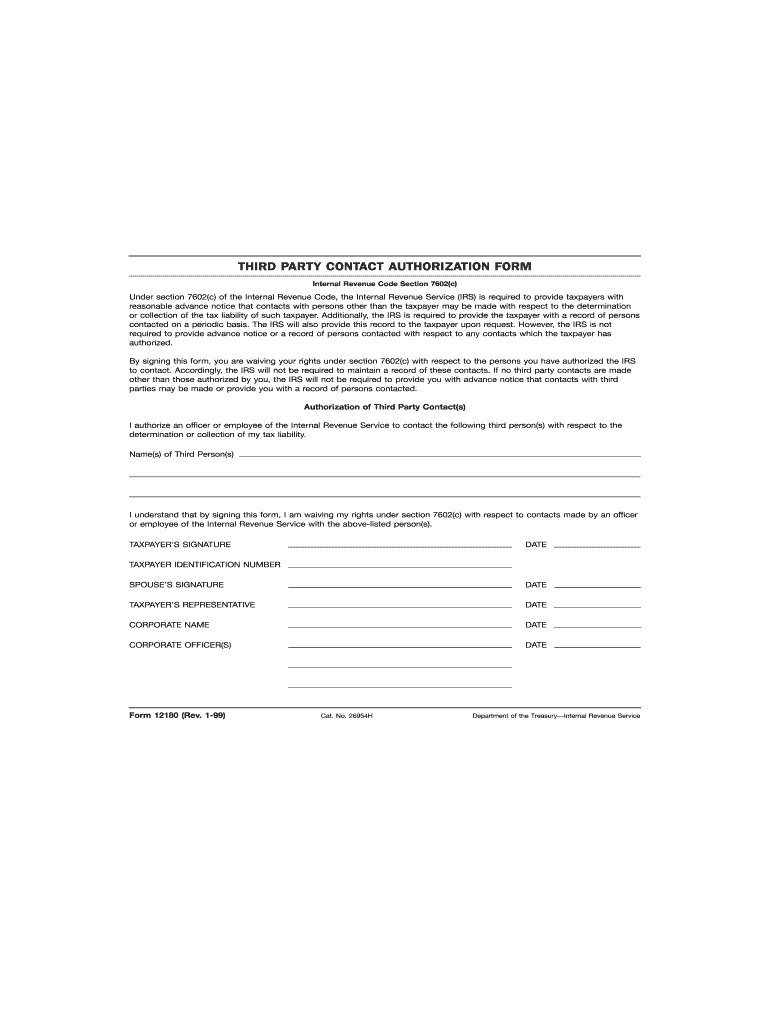

TLS have you transmitted all R text files for this cycle update Date I. R.S. SPECIFICATIONS TO BE REMOVED BEFORE PRINTING INSTRUCTIONS TO PRINTERS FORM 12180 PAGE 1 of 2 Page 2 is blank MARGINS TOP 13mm 1 2 CENTER SIDES. PAPER WHITE WRITING SUB. 20. FLAT SIZE 216mm 81 2 279mm 11 PERFORATE NONE Action Signature O. K. to print PRINTS HEAD TO HEAD INK BLACK DO NOT PRINT DO NOT PRINT DO NOT PRINT DO NOT PRINT Revised proofs requested THIRD PARTY CONTACT AUTHORIZATION FORM Internal Revenue Code...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign 12180 form pdf

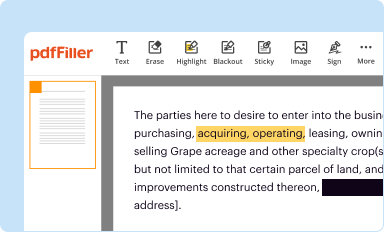

Edit your irs form 12180 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

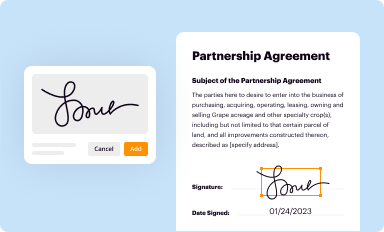

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

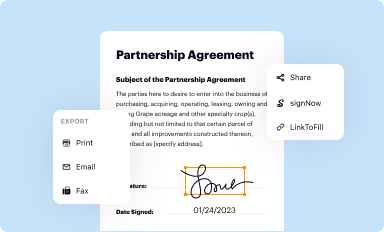

Share your form instantly

Email, fax, or share your form 12180 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs 12180 search online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

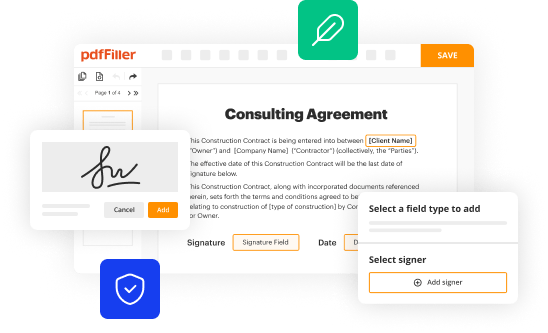

Edit 12180 authorization form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 12180 form

How to fill out IRS 12180

01

Download IRS Form 12180 from the official IRS website.

02

Read the instructions carefully before filling out the form.

03

Provide your personal information, including your name, Social Security number, and address.

04

Specify the type of request you are making on the form.

05

Complete all relevant sections, ensuring you include any necessary supporting documentation.

06

Review your entries for accuracy to avoid any delays in processing.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate IRS address listed in the instructions.

Who needs IRS 12180?

01

Individuals or entities seeking to request a refund of tax overpayments.

02

Taxpayers who need to request a ruling or determination on tax-related issues.

03

Those who have received a notice from the IRS requiring them to fill out this form.

Video instructions and help with filling out and completing writing paper

Instructions and Help about irs 12180 form

Fill

irs 12180 form

: Try Risk Free

People Also Ask about 12180 authorization

What is the difference between IRS Form 8821 and 2848?

Form 2848, Power of Attorney and Declaration of RepresentativePDF when you want to authorize an individual to represent you before the IRS, or. Form 8821, Tax Information AuthorizationPDF, when you want to name an individual to inspect confidential tax return information related to the bond issuance.

What is IRS form 8821 used for?

Form 8821 authorizes the IRS to disclose your confidential tax information to the person you appoint. This form is provided for your convenience and its use is voluntary. The information is used by the IRS to determine what confidential tax information your appointee can inspect and/or receive.

What is IRS Form 12180?

Form 12180, Third-Party Contact Authorization Form, may be used to document the taxpayer's authorization. Consent must be obtained prior to the contact being made by the IRS employee. Although taxpayers may give oral authorization, the best practice is to complete Form 12180.

Do I need both 2848 and 8821?

The key difference between the two is that Form 8821 will only allow someone to view your tax information, while Form 2848 will allow them to act on your behalf with this information. If you are experiencing any financial issues with the IRS, it's important to know the distinction between the two.

What is a 8821 form used for?

Form 8821 authorizes the IRS to disclose your confidential tax information to the person you appoint. This form is provided for your convenience and its use is voluntary. The information is used by the IRS to determine what confidential tax information your appointee can inspect and/or receive.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit irs 12180 get online?

The editing procedure is simple with pdfFiller. Open your irs 12180 pdf in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I make edits in 12180 third authorization without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing irs 12180 authorization form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for the 12180 contact form in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your 12180 third form print and you'll be done in minutes.

What is IRS 12180?

IRS 12180 is a form used by taxpayers to report specific information concerning their tax obligations and any foreign tax credits they might be entitled to.

Who is required to file IRS 12180?

Taxpayers who have foreign income or wish to claim foreign tax credits are required to file IRS 12180.

How to fill out IRS 12180?

To fill out IRS 12180, taxpayers should provide their personal information, detail their foreign income, and specify any foreign taxes paid, following the instructions provided with the form.

What is the purpose of IRS 12180?

The purpose of IRS 12180 is to assist taxpayers in reporting their foreign income and taxes, ensuring they receive the appropriate credits and deductions.

What information must be reported on IRS 12180?

The information that must be reported on IRS 12180 includes the taxpayer's identification details, description and amount of foreign income, foreign taxes paid, and any applicable deductions or credits.

Fill out your IRS 12180 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs 12180 Contact Fillable is not the form you're looking for?Search for another form here.

Keywords relevant to 12180 third party contact form

Related to 12180 third party authorization

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.